Bitpanda Staking

Bitpanda, as one of the leading crypto exchanges in Europe, has expanded its range of functions and has been offering staking of various assets since May 2022. As with all other features, Bitpanda focuses on user-friendliness and ease of use. Bitpanda is a highly recommended platform, especially for newcomers to crypto. The developers have done a great job here and you are introduced to the functions in a playful way. This article aims to provide a simple overview of staking and especially staking on Bitpanda.

What is staking?

In simple terms, staking is the process that enables participants in a blockchain network to receive rewards. They must lock their coins in their wallet in order to receive the rewards. These blocked coins are then used to confirm transactions in the respective network or are used as liquidity. Participants then receive their rewards for these actions. Staking rewards from cryptocurrencies are comparable to interest from our fiat currencies. As long as there is money in our savings account, interest is paid out. It works in a similar way with staked assets. The amount of interest depends on the amount of cryptocurrencies and the period for which they are staked.

How does Bitpanda Staking work?

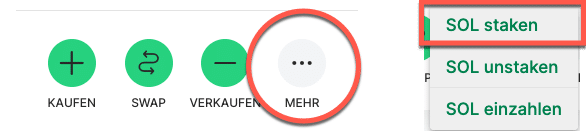

As mentioned at the beginning, Bitpanda focuses on simplicity and users of the platform do not have to worry about any blockchain interactions. Owning the respective assets on Bitpanda is sufficient to qualify for staking. An additional button then appears on the cryptocurrency that allows staking to begin.

As soon as you click on stake, a modal appears asking for the desired quantity:

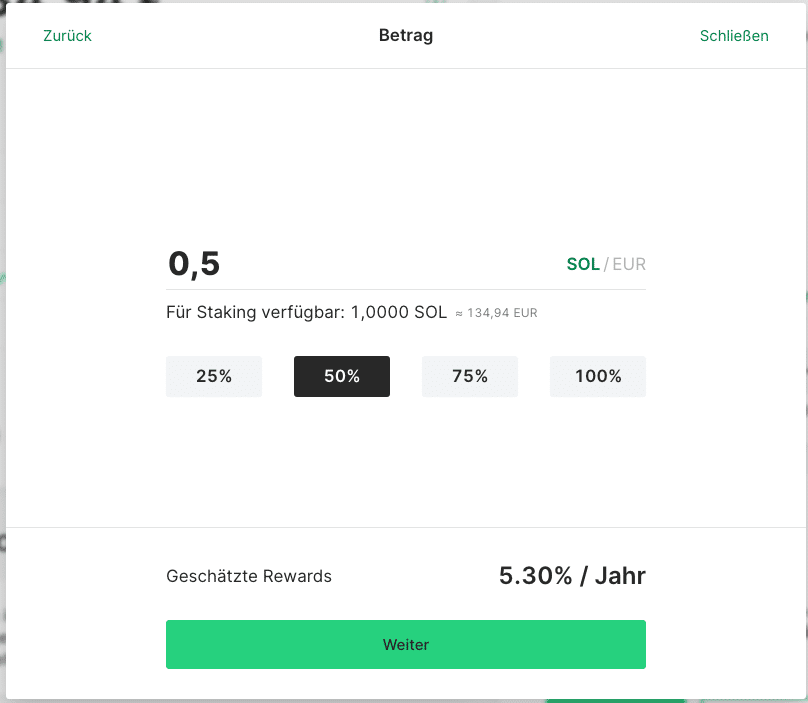

Click on the “Continue” button to confirm and agree to the terms and conditions, after which the success message is displayed and when you can expect to receive the first staking rewards on Bitpanda.

Is there a locking period for Bitpanda’s staking assets?

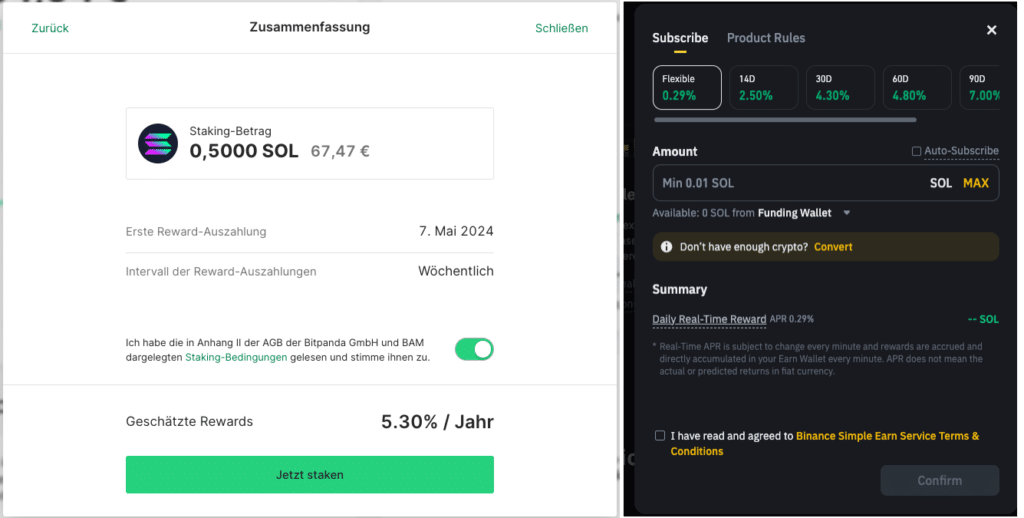

Bitpanda also stands out from the crowd when it comes to the holding period and tries to avoid the holding period as much as possible. Currently (as of 05.05.2024), only Ethereum has an unlocking period of 2 days. All other staking assets can be removed immediately after the start and the cryptocurrencies are immediately available again. Of course, competitors also offer staking without a locking period, but the potential rewards differ enormously. Binance, for example, only offers comparable rewards after a holding period of 60 days:

How often are staking rewards paid out?

Bitpanda’s staking rewards are paid out at weekly intervals. This usually takes place on Tuesdays in the evening. The summary of the rewards received is usually sent by email the following day. You can also see when and how many assets you have received on the cryptocurrencies overview page. The rewards you receive are automatically added to your staked pool, allowing you to benefit even more from the compound interest effect.

What staking rewards / returns can I expect?

Since staking rewards depend on external factors, such as the number of participants in a network, the returns can vary. Bitpanda provides a value based on current factors, which can change at any time.

In addition to the normal rewards, you can increase your rewards by up to 12.5% by holding BEST (Bitpanda Ecosystem Token).

| BEST VIP Level | Staking Rewards |

| VIP LVL 1 (>= 10 BEST) | + 2.5% |

| VIP LVL 2 (>= 1,000 BEST) | + 5.0% |

| VIP LVL 3 (>= 5,000 BEST) | + 7.5% |

| VIP LVL 4 (>= 10,000 BEST) | + 10% |

| VIP LVL 5 (>= 50,000 BEST) | + 12.5% |

All staking rewards of the current assets can be calculated here, taking into account the BEST VIP level.

Which cryptocurrencies does Bitpanda offer for staking?

Bitpanda regularly expands the staking assets it offers. Below is a list of all current stakeable cryptocurrencies, sorted in descending order by their corresponding APY:

| Asset | APY |

|---|---|

|

Axie Infinity Shard

AXS

|

25,00% |

|

Audius

AUDIO

|

14,19% |

|

Kusama

KSM

|

13,18% |

|

ApeCoin

APE

|

12,00% |

|

Cosmos

ATOM

|

12,00% |

|

Polkadot

DOT

|

11,50% |

|

Injective

INJ

|

10,00% |

|

Secret

SCRT

|

10,00% |

|

Akash

AKT

|

10,00% |

|

Osmosis

OSMO

|

8,32% |

|

Saga

SAGA

|

8,00% |

|

Aleph Zero

AZERO

|

8,00% |

|

Celestia

TIA

|

8,00% |

|

Casper

CSPR

|

7,00% |

|

Zilliqa

ZIL

|

7,00% |

|

NEAR Protocol

NEAR

|

6,88% |

|

The Graph

GRT

|

6,87% |

|

Ronin

RONIN

|

6,80% |

|

Fetch.ai

FET

|

6,40% |

|

Harmony

ONE

|

5,50% |

|

Solana

SOL

|

5,30% |

|

Kava

KAVA

|

5,30% |

|

Dymension

DYM

|

5,00% |

|

Mina

MINA

|

5,00% |

|

Flow

FLOW

|

4,80% |

|

Avalanche

AVAX

|

4,80% |

|

Tezos

XTZ

|

4,70% |

|

Aptos

APT

|

4,70% |

|

MultiversX

EGLD

|

4,10% |

|

Aave

AAVE

|

4,00% |

|

Moonbeam

GLMR

|

4,00% |

|

Polygon

MATIC

|

3,82% |

|

ZetaChain

ZETA

|

3,70% |

|

Sei

SEI

|

3,70% |

|

Celer Network

CELR

|

3,50% |

|

Ethereum

ETH

|

3,00% |

|

Tron

TRX

|

2,68% |

|

Cardano

ADA

|

2,10% |

|

Sui

SUI

|

2,00% |

|

Oasis Network

ROSE

|

1,80% |

|

Fantom

FTM

|

1,50% |

|

BNB

BNB

|

0,30% |