Bitpanda Limit Orders

Lukas Kurzmann

Lukas Kurzmann

Since May 24, 2024, Bitpanda has introduced limit orders starting for VIP Gold members. At the start there are only limit buy orders. Sell orders will be introduced from June/July 2024. This enables and simplifies the automation & planning of your investment by setting automatic orders. The available assets and functionalities will be systematically expanded. This article explains limit orders, their advantages and disadvantages and how they can be used on Bitpanda.

What are limit orders?

A limit order is an order to buy or sell a certain quantity of assets at a certain price. The desired buy/sell price is set and as soon as this is reached, the order is triggered and the purchase or sale is executed. A distinction is made between buy and sell limit orders. Normally, buy orders are only executed if the price falls below a lower price. The opposite is true for sell orders, which are normally only triggered when the set price is exceeded. At Bitpanda, buy and sell orders are triggered in both directions. This means that it is also possible to specify a significantly higher price for a buy order, which is only triggered when this price is exceeded.

What is the difference between market & limit order?

The difference between a market order and a limit order is that the market order is executed immediately at the current price. Whereas a limit order is only executed when the set price is reached. If you want to buy an asset immediately and the price does not matter, you can use market orders.

What are the advantages of limit orders?

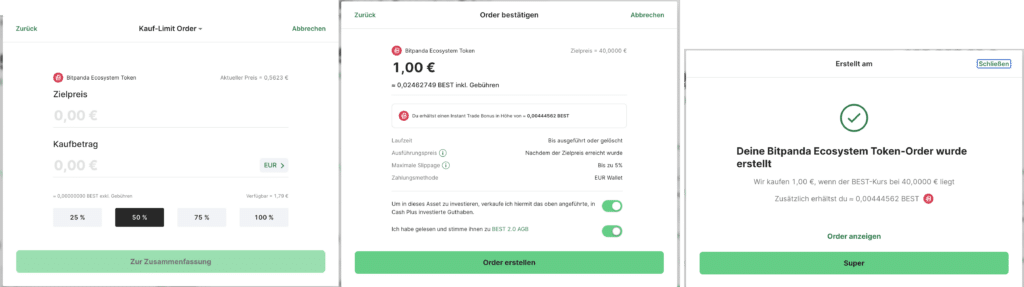

One of the biggest advantages of limit orders is that you do not have to constantly monitor the price in order to be able to buy at a desired price. This can be an advantage, especially in volatile markets. By setting the order, you have the opportunity to follow and adhere to your strategies and plans even more closely. With Bitpanda, it should be noted that a deviation (slippage) of up to 5% can occur with limit orders. However, as soon as this 5% is exceeded, the order is automatically canceled by Bitpanda.

What are the disadvantages of limit orders?

The risk that can occur with limit orders is that the desired price is never reached and therefore the order is never executed.

How do I create a limit order on Bitpanda?

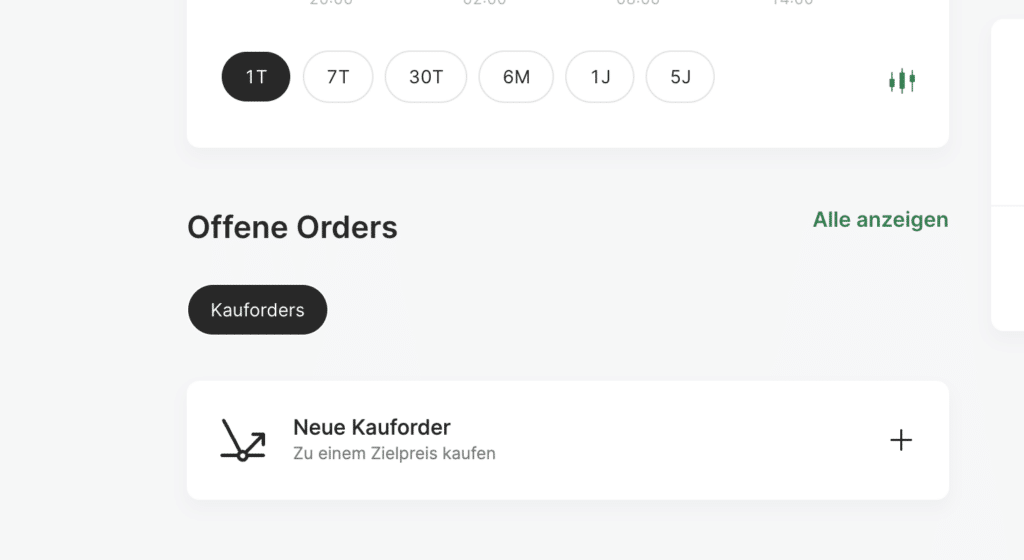

For all assets available for limit orders, there is now the additional function to create a new limit order.

Click on “New buy order” to open a modal and you will be guided step by step to successfully create a limit order. You must enter your target price and desired purchase amount and agree to the terms and conditions. Once the order has been successfully created, a success message is displayed:

What are the fees for Bitpanda limit orders?

There are no additional fees for creating limit orders. Fiat currencies that have just been invested as Cash Plus also remain there and continue to earn monthly interest. When the order is executed, the normal Bitpanda fees are retained, which are otherwise also retained for a normal purchase.

Conclusion of limit orders on Bitpanda

To summarize, it can be said that limit orders complete the functionality of the European broker Bitpanda. It is now even easier to follow your own strategies without having to constantly monitor the price and wait for the desired price. The fact that the invested capital remains available and can, for example, remain in Cash Plus and continue to earn interest also speaks in favor of the new feature. All in all, a very successful expansion of the broker.